Hi. I'm John

an economist turned designer. I'm passionate about using technology to enable better customer experiences that build brands.

About

Currently, I’m a sr. venture design lead guiding cross-functional teams to build tools and businesses to power the future of decentralized finance. My work relies on close collaboration with diverse groups of stakeholders and subject matter experts. I have over 7 years of experience advocating for end-users and creating solutions that drive business results with a focus on user research, design strategy, feature validation, and design system development. While working with Global Business Services for the Coca-Cola Company I led the design of software for clients all over the world including finance, IT security, procurement, and global marketing.

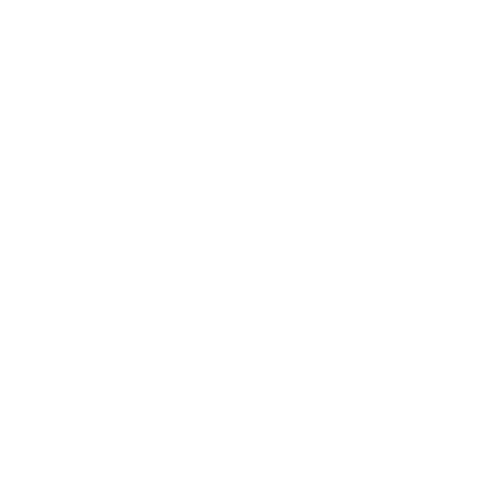

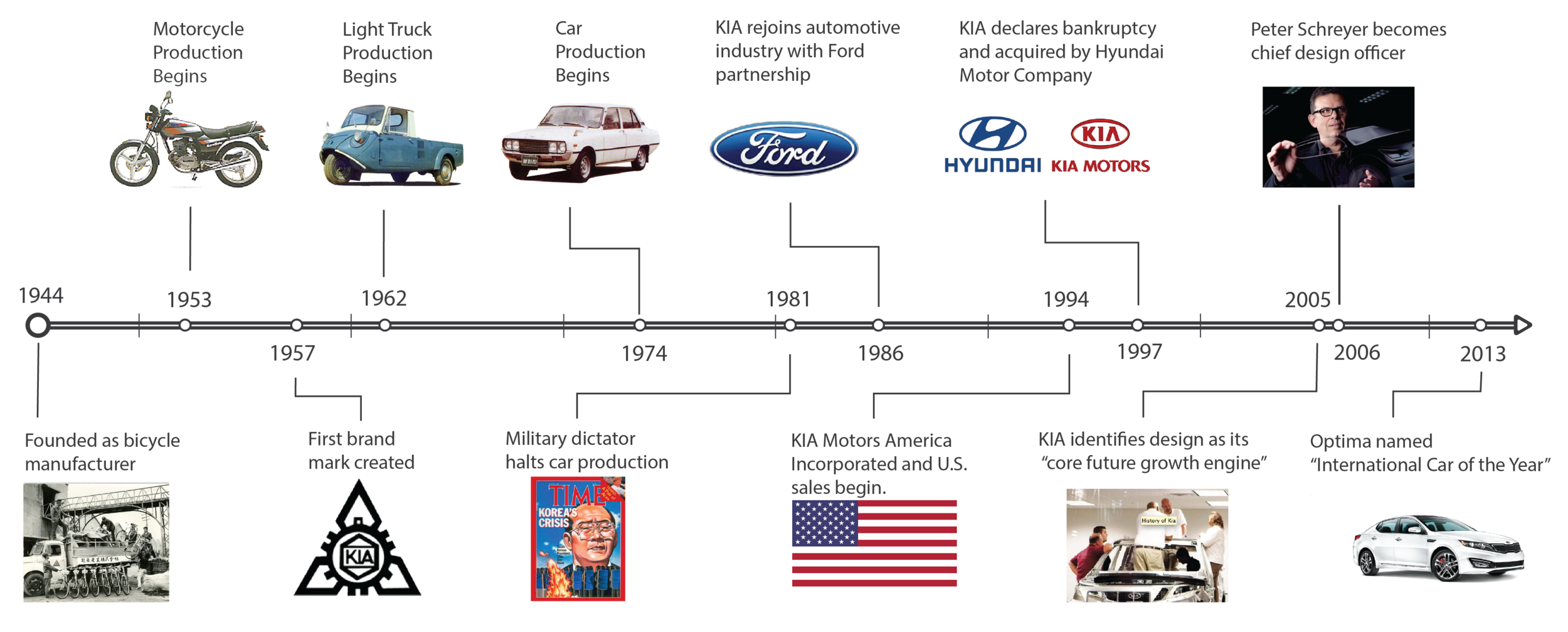

I received a BBA as well as a BA from Mercer University (Macon, GA) with an emphasis on business finance and economics. After graduation, I worked abroad in the Republic of Korea where I became intrigued with how different cultures approach the design of products and services. After returning to the U.S. and working in business consulting, I realized that design is where my true passion lies and enrolled in Georgia Tech's prestigious Master of Industrial Design program.

At Georgia Tech, I broadened my skill set and developed a strong understanding of human-centered design process. Grounding these skills with my knowledge of business organization and strategy has given me a unique ability to identify design opportunities around stakeholder needs. Now as I continue to develop my skills, I am eager to take on new challenges and create designs that benefit all stakeholders. Design research, service innovation, futures, and UX are areas in which I have particular interest.

Beyond design, I am an avid traveler and lover of cultures. I have been fortunate to visit 29 countries across 4 continents and value the experience and insight these travels have given me more than anything. When I am not working, I am active: exercising, snowboarding, hiking, woodworking, or exploring the city of Denver. I am always seeking out new experiences and trying to learn as much as I can from them.